Accounting Basics

First, before doing anything with the way accounts behave and having to remember what they increase and decrease with, you want to know where to find them.

In Lizzy, accounts are grouped by type and they are as follows:

- Cash (100 – 109 range)

- Accounts Receivable (110-119 range)

- Inventory (120-129 range)

- Other Assets (140-149, 160 – 179 range)

- Fixed Assets / Accumulated Depreciation (150 – 159 range)

- Accounts Payable (210 – 219 range)

- Other Current Liabilities (220-269 range)

- Long Term Liabilities (270 – 289 range)

- Equity (300 – 399 range)

- Income / Sales (400-499 range)

- Cost of Goods Sold (COGS) (500-599 range)

- Expenses (600-699 range)

It is important that when you are creating accounts in the chart of accounts, that you group them accordingly. Also, when creating expense accounts, to help keep your general operating expenses in a semblance of alphabetical order on your Profit & Loss Statement, use the following schematic:

600 – A’s, 601 – B’s, 602 – C’s, etc.

Each account behaves in one of two ways – they either increase or decrease. We follow an Acronym for remembering how accounts behave.

DEAD CLIP

D – Debit

- E-Expenses

- A – Assets

- D – Drawing (owner deductions – basically CONTRA Equity)

C-Credit

- L – Liabilities

- I – Income (REvenue / Sales)

- P – Proprietorship (Equity)

DEAD accounts increase with Debits, and CLIP accounts increase with Credits. So, if you are doing a GL Adjustment and you need an income account to increase, you would CREDIT the income account. If you were to say: Deposit money into your checking account which is an asset type account, then to add to the checking you’d debit the account. (Yes we know this is not very intuitive but hey, we didn’t create it. “-)

Lizzy requires every GL entry to be balanced. So, if you are crediting something – this is one side of the “=” sign you need to debit something else. It doesn’t matter if you are debiting a hundred things and crediting just one – the total on one side of the = sign needs to match the total on the other.

The actual accounting formula Lizzy uses is: Assets = Liabilities + Owners Equity

The best way to think about this is that anything on the right side of the equation is logical. By this I mean debits are things that decrease and credits are increasing. But as soon as you move to the left side of the equation, the world flips on its head. Nothing is logical on the left side, which means if I want to add money to checking, which is an asset, I have to debit the account not credit.

There is no logic to be applied here so just give it up. The most complicated thing in accounting is figuring out if the account you’re dealing with is an asset or something else. Lucky for you though, Lizzy does all the figuring for you, so you just need to choose the accounts and Lizzy will correctly determine if she’s adding or subtracting. It is important though to understand that in any double entry accounting system you MUST keep your debits and credits equal to each other in order for them to be posted. It doesn’t matter if the entire transaction happens on one side of the equation or not, they just have to balance.

Basic Definitions

- C.O.G.S = Cost of Goods Sold – which is the expense of selling something

- Expense = the cost of running the business

- Assets – Everything the business owns

- Liabilities – Share of the business you don’t own

- Capital (equity) – Share of the business you do own

- Contra – A Contra account is an account that behaves in the opposite way. So, for example, a Sales Discount account is negative sale hit – which is negative income – so you would create a CONTRA Income account.

Basic Equations

Financial Reports are basically equations running to provide you with financial data:

- Balance Sheet Equation = Assets – Liabilities = Equity

- Profit & Loss Equation = Income – COGS – Expenses = Net Income

Now that we have the basics down, lets look at an actual accounting scenario:

You buy a part for $2.00 from your supplier, and you sell it for $5.00. You deposit the money into the bank and pay your supplier. This is what would happen on the GL in the system if we track this:

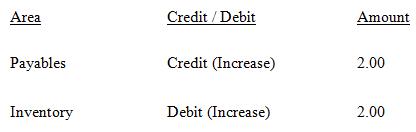

Buy a part on a PO for $2.00

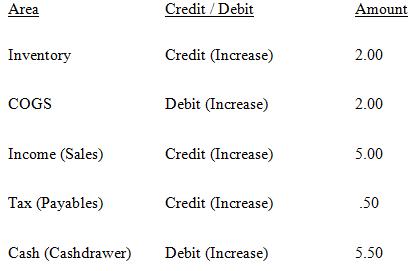

Sell the part for $5.00 + .50 cents tax

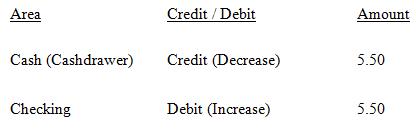

Depositing Money into Checking

As you can see, we took the equation up above, DEAD CLIP and applied it on paper to what is transpiring when you buy the part, sell it, deposit the money, and pay it off.

I hope after reading this, you have a better understanding of the accounting basics that happen in Lizzy.